Home Industry Automobile Volkswagen CFO flaunts benefit...

Automobile

CIO Bulletin

05 September, 2022

Porsche’s potential stock market listing is central to funding Volkswagen’s electrification plan, the automaker’s chief financial officer said ahead of a board meeting to discuss whether the listing will go on.

Volkswagen’s management and supervisory boards will meet to discuss whether Porsche’s long-anticipated listing should occur in late September or early October.

Should Volkswagen state its intention to float, a roughly four-week period would follow for buyers to express interest in the stock, during which the carmaker could still pull the listing if interest is lacking.

Few investors have questioned the timing of the move, reasoning that market jitters could suggest far lower proceeds than hoped and pointing to outstanding questions about how Oliver Blume will govern both Volkswagen and Porsche.

Stocks across the European industry have been free-fall this year, with luxury automakers no exception. Aston Martin stock was down 11%, having earlier dropped 14% after launching a 578.5 million pound ($662.86 million) rights issue of four new shares for each existing share.

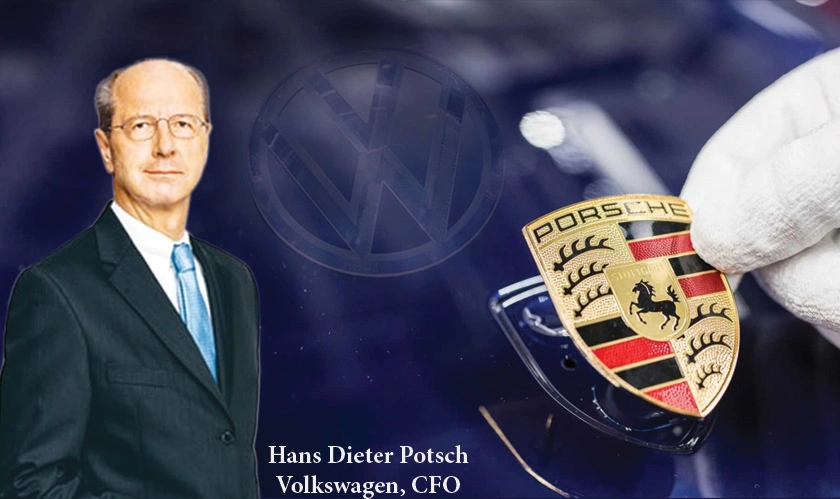

Yet, Arno Antlitz, who was appointed VW chief operating officer alongside his role as a chief financial officer on September 1, 2022, when Blume became CEO, reiterated Volkswagen’s defense of the listing as key to raising funds for the automaker’s electrification goals.

Porsche SE said in a statement on Saturday that the launch was still subject to further board discussions and market developments.

Insurance and capital markets