10 Hottest Tech Companies 2021

CIO Bulletin

Trendrating is a global leader in the field of advanced analytics and portfolio management technology, serving thousands of asset owners worldwide and strategic partners such as Bloomberg and Euronext. We interviewed Rocco Pellegrinelli, the Founder and CEO of Trendrating, to know more about the company and its services. Here are a few excerpts of the interview:

Provide an overview of Trendrating

The founders of Trendrating have 25 years of experience in building models and software for asset and wealth managers, with a successful track record of providing innovative, world class solutions. The core team includes a seasoned group of passionate developers, mathematicians, and quants. Trendrating has become the leader in advanced analytics and technology serving 200+ institutions globally. We cover more than 20,000 instruments including stocks, ETFs, commodities and currencies on a global scale. Our unique proprietary rating methodology has the ability to identify and score the prevailing price trend of a security with high accuracy. The ability to distinguish between securities based on their respective price trend should be of paramount importance to every portfolio manager, no matter the investment strategy type. Trendrating serves professional investors that strive for constant improvement and, aim at delivering superior value, thereby understanding the importance of not missing opportunities offered by the new generation of data and advanced technology that are in tune with an evolving world. Our key strategic partners include Bloomberg and Euronext.

Q. What is your view on the current state of the market with regards to how asset managers are managing their investment portfolios? What are they doing well, what are the challenges and what areas could be improved?

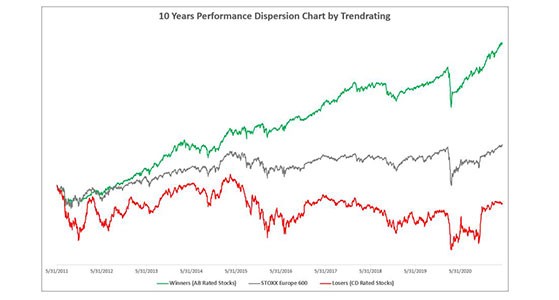

Over the last few years not much has been developed or invented in terms of analytics and methodologies. The dynamics in the stock market are rapidly evolving, and individual securities price trends are now driven by a variety of factors, where fundamentals are just one element. Many active managers are hostage of the status quo, practicing a decision process developed many years ago and dismiss the importance of incorporating innovative analytics and tools that can dramatically improve their performance. This is why many mutual funds continue to underperform the benchmarks (see SPIVA reports) with the result that the shift of investors’ money into passive products is accelerating (more than 400 bn in 2020). The main challenge for active managers is clear – finding a way to deliver on performance. But if nothing has changed in the investment decision process it is difficult to expect a change in returns vs. the benchmarks. So what’s the fix? The opportunity for active managers is called “performance dispersion,” a structural phenomenon of stock markets. In any investment universe, however selected, the performance dispersion is observable at any time. for example in 2020, the S&P 500 recorded a +16% gain, while the top 25% performers recorded an average gain of +110%, and the bottom 25% a -17%. The differential is massive.

The magnitude of performance dispersion is increasing in a market where trends feed themselves as a result of more forces at work. Performance dispersion can be a gold mine for active managers

with the vision and the tools to exploit it. By maximizing the exposure on holding the best performers while avoiding some of the underperformers one can easily beat the benchmark. It seems overly simplistic, but it requires a careful re-evaluation of assumptions of existing processes.

All the fundamental research of the world is worth little if it does not get the specific trends right. Not every stock with good fundamentals will turn out to be a rewarding investment. And how many big profit opportunities are missed simply because some rigid metrics are not satisfied? But in the meantime, other pragmatic investors make big money with stocks that defy gravity for a long time.

Active managers can recognize the importance of respecting trends and the opportunity of profiting from them by simply adding a trend assessment layer to enhance the selection and the allocation across stocks. The main reason for underperformance is the wrong allocation across performance dispersion in the chosen universe.

Q. What solutions does your company offer the market and how do they help asset management firms manage their investment portfolios better?

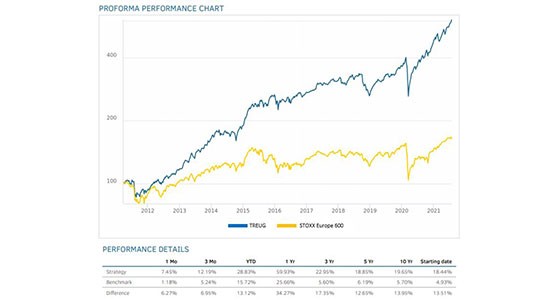

Profiting from performance dispersion requires access to well tested analytics and technology specifically developed for this sophisticated task. The mission of Trendrating is to provide solutions that complement market analysis and portfolio management to improve the performance and enhance risk management. We developed a methodology to assign a rating grade to price trends with a time-window of 6-to-24 months. The trends within that timeline are ones that typically have the most impact on yearly performance. Our model is based on multiple factors and has been in production since 2013. We also introduced a new metric of risk control for equity portfolios. The portfolio trend rating measures the aggregated exposure to bull trends vs. bear trends. The higher the portfolio rating the higher is the expected return. Clients can compare the trend rating of their portfolios against the benchmark and run an objective sanity check with good predictive value. If the portfolio rating is lower than the index rating, then there is a high risk to underperform. Our company offers a broad range of products that support different tasks such as: Risk management, Portfolio optimization, Tactical allocation and Strategy development.

We recently introduced a very powerful functionality that enables our customers to combine fundamental metrics with our trend rating validation models which tests a strategy across any desired investment universe. It is extremely flexible and fast to adjust any parameter and rule and optimize the strategy until achieving the desired results on a 10 year back test and then launch and track each strategy. It includes comprehensive reporting tools.

This powerful and flexible technology, combined with access to a rich set of data and analytics, enables asset managers to explore how to profit from performance dispersion, combining good fundamentals and confirmed price action to maximize returns that cover key metrics.The same technology has been used to develop a family of Trendrating indices to prove the point. We are now launching a service offering a comprehensive selection of model portfolios for those professional investors that want ready-to-go content. The model portfolios include versions based on growth and value strategies on a global scale by incorporating a trend validation filter to profit from dispersion.

Q. If you have a message to pass on, what would it be?

It is a very exciting time for smart active managers!

Meet the Founder

Rocco Pellegrinelli began his career as a portfolio manager and quickly learned the advantage of developing models to bring discipline and quality control to the investment decision process, which is often hostage to opinions, biases, and poorly tested methodologies. He has been a successful entrepreneur in the technology sector for the past 20 years. He created Brainpower in 1996 and as Chairman and CEO, established it as one of the top portfolio management systems globally. After taking the company public on the Frankfurt Stock Exchange in 2000, Brainpower was acquired by Bloomberg in 2006. His vision is encapsulated by the view that “Many analytical tools make sense, but do they also make money? It is time to bring real value to fund managers.” Rocco believes that the asset and wealth management industries need to evolve toward higher standards of value to clients, efficiency and cost effectiveness, therefore adopting new data and sophisticated tools is seen as the only solution. Rocco launched Trendrating with the mission of providing innovative analytics and technology that deliver alpha in a measurable, actionable, and repeatable way. In response to Trendrating success, Rocco was nominated by Industry Tech Outlook as one of the “10 Most Inspiring CEOs to Watch in 2020”. Rocco is also a Nasdaq contributor to their Advisor Portal.

Insurance and capital markets