Home industry startups square to acquire Australian company Afterpay for $29 billion in stock

Startups

CIO Bulletin

2021-08-02

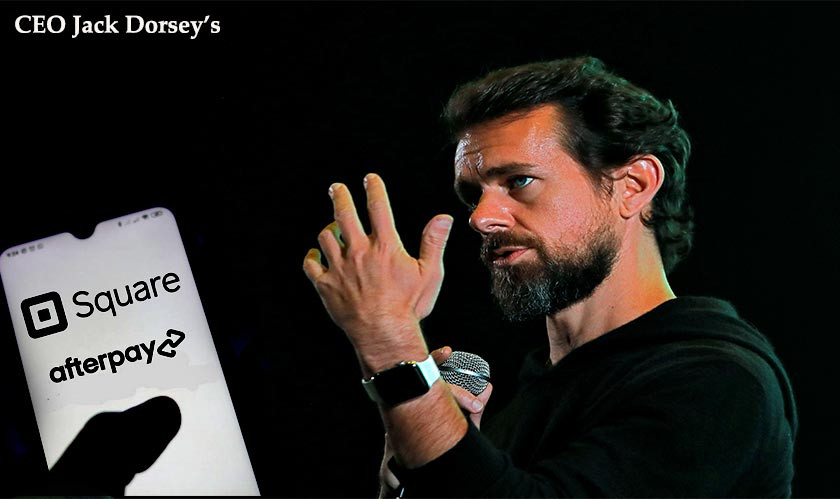

“Square and Afterpay have a shared purpose,” said Square’s CEO Dorsey in a statement Square plans to buy Australian fintech company Afterpay as it eyes the booming installment loan market. Afterpay, founded in 2014 by Australians Nick Molnar and Anthony Eisen, has an international presence already and offers a “buy now, pay later” service that lets you pay for purchases in installments interest-free. Jack Dorsey’s payments company announced the $29 billion, all-stock deal on Sunday evening. The price tag marks a roughly 30% premium to Afterpay’s last closing price.

“Square and Afterpay have a shared purpose,” said Square’s CEO Dorsey in a statement. “We built our business to make the financial system more fair, accessible, and inclusive, and Afterpay has built a trusted brand aligned with those principles.”

According to a press release, Afterpay already serves more than 16 million customers and nearly 100,000 merchants across the world. The transaction is expected to close in the first quarter of 2022. Once the acquisition is completed, Square will appoint an Afterpay director to join Square’s board. Shares of Afterpay in Australia surged on this news and closed nearly 19% higher on Monday.

Square aims to target traditional credit, especially younger buyers. The San Francisco-based payments company already offers installment loans, which has been a powerful growth tool for Square’s core seller business. It also plans to integrate Afterpay into both its seller and Cash App ecosystems. In recent weeks there have been reports that Apple is also working on its own service that would allow shoppers to pay for purchases in installments.

Banking-and-finance

Artificial-intelligence

Travel-and-hospitality

Management-consulting

Banking-and-finance

Banking-and-finance

Food-and-beverage

Travel-and-hospitality

Food-and-beverage