CIO Bulletin

Risk and return are the two essential aspects of financial investment. Risk is the probability of suffering losses, whereas return is an income earned through an investment. The higher the risk, the higher the return on investment and vice versa. Individual investors like to minimize risk as much as possible.

As an investor, to maximize your investment portfolio’s value, you must be actively involved in portfolio management. By doing so, you will be able to protect your money from market hazards and maximize your profits properly.

Managing your investment portfolio is crucial is staying at the top of your financial health. It helps you make well-informed decisions regarding your investments. It includes deciding the ideal investment mix based on your risk tolerance. It returns expectations, aligns them to your financial goals, and reshuffles funds among various avenues based on their performance.

All types of investors need an investment portfolio to invest optimally. It can be constructed using both short-term and long-term investment choices. Asset management companies (AMCs) enable investors to invest in the best investment opportunities. They customize an investment plan based on specific requirements, risk appetite, and return expectations of customers.

Trendrating is one of the best portfolio management companies to help your organization. Trendrating is a global leader in the fields of advanced analytics and portfolio management technology, serving thousands of asset managers worldwide, counting strategic partners such as Bloomberg and Euronext.

Their proprietary and unique trend-capture and rating methodologies are used as part of their investment decision-making process in the asset management, wealth management, private banking, advisory, hedge funds, and family offices fields to maximize returns and better control risks.

The following excerpts are taken from a conversation with Rocco Pellegrinelli, Founder and CEO of Trendrating.

Q. How has stock market behavior changed in recent years?

There was a time when fundamentals were driving the price trends of stocks. The correlation between actual price action and fundamentals has decreased over the years. Today the world is more complex. Investors can be driven by several factors, including social media influence, rapid shifts in sentiment, and fast-changing economic scenarios. The big pools of money controlled by prominent players as sovereign funds can rapidly adjust the allocation based on shifting strategies. A growing army of momentum players creates and fuels trends up and down. Furthermore, the business of indexing and the flow in and out of passive products accelerate whatever trend is in force in the selected securities. So, in the end, trends result from combining several forces at work, where fundamental valuations have a reduced impact.

Q. So what is the solution?

Let’s go to the basics, and let’s be pragmatic.

Price trends result from the combined impact of buyers and sellers for any specific stock. A bull trend is produced if buyers’ aggregated money flow exceeds sellers’ outflow consistently. A bear phase happens when the balance is weighted on the sellers’ side.

Acknowledging and respecting trends is the essence of successful investing. Disregarding trends is nonsense. Stock markets offer a fantastic opportunity to active managers – the performance dispersion.

Performance dispersion is inherent and recurrent across market cycles. For example, during the last six months in the US market, the S&P 500 index posted a loss of 18%. Still, the dispersion across the stocks in the index shows that the top 25% performers on average gained 16% and the bottom 25% performers lost on average 43%, for a differential of 59% in 6 months between the two segments.

Active managers with the right analytics and tools can try and capture a good part of the top performers while avoiding most of the bottom performers and then generate positive returns consistently.

But profiting from the performance distribution across stocks and sectors requires two things:

So it is all about adding leading-edge intelligent data and rejuvenating investment strategies that, for too many years, did not evolve. It is time to use all the information that can make a difference. For many investors, conventional data and methodologies alone did not help limit the yearly portfolio losses to date.

Q. How can investors profit from dispersion and better control risks?

As said, a solid “trend assessment” for every stock in the portfolio and the desired investment universe is now a must-have. The selection of the methodology to use is critical.

In my opinion, subjective analysis, based on human interpretation, risks being inconsistent, if not erratic, as it is often misled by market volatility and personal biases. Models work better as they are objective and can be massively tested, documented, and validated. Some models are based on momentum metrics. They tend to work well during long-lasting trends, but by design, they can be late at capturing trend reversals and, therefore, less effective during more struggling cycles.

Q. What is your take on the investment strategies landscape?

Many investment strategies have been developed years ago and have never been refreshed with advanced analytics and up-to-date tools. They did not adapt to the evolution of today’s stock markets that are governed by various factors and fast-changing dynamics that dictate price trends and behavior.

It is time for reassessment and revision as the current market cycle is challenging. Investment strategies that work in a protracted bull trend can be inadequate to handle a different market.

We anticipate an unavoidable evolution for conventional investment strategies as we enter a low to negative returns market cycle that can last years.

Tell us about your solution.

Our team has 25+years of experience developing models and systems for portfolio management.

Over the years, we developed a proprietary model and a functionality-rich technology that is today used by 200+ institutional customers as part of their investment decision process.

The model is a multi-factor algorithm live since 2013. It was massively tested on 20,000 stocks across the previous 20 years of history and never modified.

The model works on deciphering the aggregated investors’ money flow in and out of stocks to discover actual bull and bear trends early. The result is a rating methodology that makes a valuable complement to the information structure, where (A) and (B) ratings identify bull trends and (C) and (D) rating signal bear phases.

The model’s accuracy is extensively documented and proved particularly effective in identifying the current bear market back in January.

Trendrating solution combines rating analytics and a rich set of fundamental data with a broad range of tools supporting several market analysis and portfolio management tasks.

Q. Who are your customers, and how do they use your solution?

We serve asset managers, fund managers, wealth managers, sovereign funds, hedge funds, and RIAs on a global scale.

Some customers use our advanced analytics to add a layer of control and validation, enriching the information flow. Others are more systematic and leverage the system extensively across the investment management process.

The most common use cases are: Risk control on holdings, Ranking and Validation of investment ideas, Sectors rotation and allocation, Portfolio optimization, and Strategy testing and enhancement.

Q. Is the bear market changing the way your clients use your solution?

We observe an increasing interest in two directions.

One is a more stringent risk control across the portfolios. More and more investors realize they cannot ignore the “trend risk.” This is the risk of holding a stock that starts turning down, telling that the selling pressure outweighs the buying interest and may experience a bear trend, whose extent is uncertain. Managing multiple portfolios makes it challenging to oversee all the holdings and spot negative trend reversals that generate new risks in time. Trendrating enables the efficient monitoring of all the equity exposure via a prompt alerting in case of emerging “trend risks” in any security. A downgrade points to a high probability of more damage to follow.

Another trend we see is a growing appetite for designing and launching new investable products, better geared (suited) for the changing market cycle. The new market cycle is changing the game for product issuers. The end of the 12 years bull market will expose the inadequacy of many investable products that prospered in the good days. As investors realize that a passive product can be a source of repetitive losses, they will shift assets elsewhere. And the opportunity is filling the inevitable future demand for intelligent products that can deliver gains also in a low to negative returns cycle that can last years.

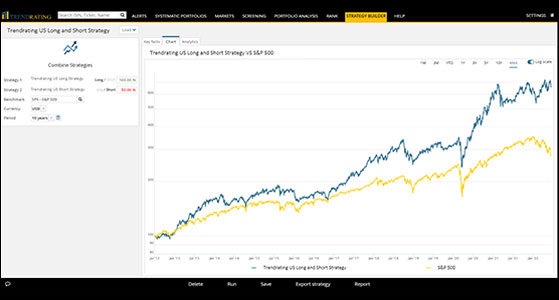

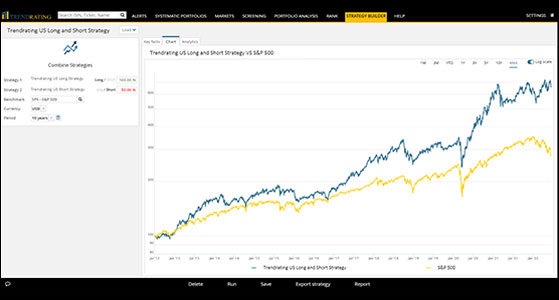

Farsighted operators launching innovative products will capture a significant share of the reallocation of the assets at the expense of those that will persist with a conventional offer range, detached from the new course. Trendrating solutions can support the launch of long and short products combining fundamentals and trend capture models. For example, going long stocks displays good value and positive trends in motion, while shorting securities has poor value and a negative trend rating. Strategies combining long and short exposure on stocks can exploit the trends dispersion and provide attractive returns and low risks.

Q. Any final thought?

I can only recommend that active portfolio managers step up their strategies by integrating the new generation data and tools made available in the last few years. The new market cycle can mark the vindication of active management vs. passive strategies.

If indices deliver low to negative returns for some time, then active managers can prove their value and gain back part of the assets that switched to passive products for years. But active managers need and deserve better content and solutions. Providing them is Trendrating’s mission.

Trendrating Delivering unique portfolio management technology and analytics worldwide

From starting as a portfolio manager to founding Trendrating, Rocco Pellegrinelli, Founder and CEO has come a long way. He launched Brainpower in 1996 and established it as one of the top portfolio management systems globally. After taking the company public on the Frankfurt Stock Exchange in 2000, Brainpower was acquired by Bloomberg in 2006.

Then, he started a research and development project to design a superior model to capture price trends in listed equities. After a few years of massive testing of 350 indicators and thousands of combinations across 25 years of history for 20,000 securities he got what he wanted. It helped to have the support of a fantastic team of experts, now part of Trendrating, a leading provider of advanced analytics and leading-edge technology for equity investing, serving more than 200 institutional customers on a global scale.

In 2020, Rocco was nominated as one of the “10 Most Inspiring CEOs to Watch” by Industry Tech Outlook and one of the “10 Best Innovative Leaders” by DigiTech Insight. Rocco is also a Nasdaq contributor to their advisor portal.

Insurance and capital markets