50 Best Companies to Watch 2021

CIO Bulletin

Smartphones, wind turbines, and electric cars are becoming standard features of modern life and are closely linked to a low-carbon, globally connected future. This has increased the demand for greater quantities and variety of metals to build these products, but access to many of them is restricted due to their geological or geopolitical situation.

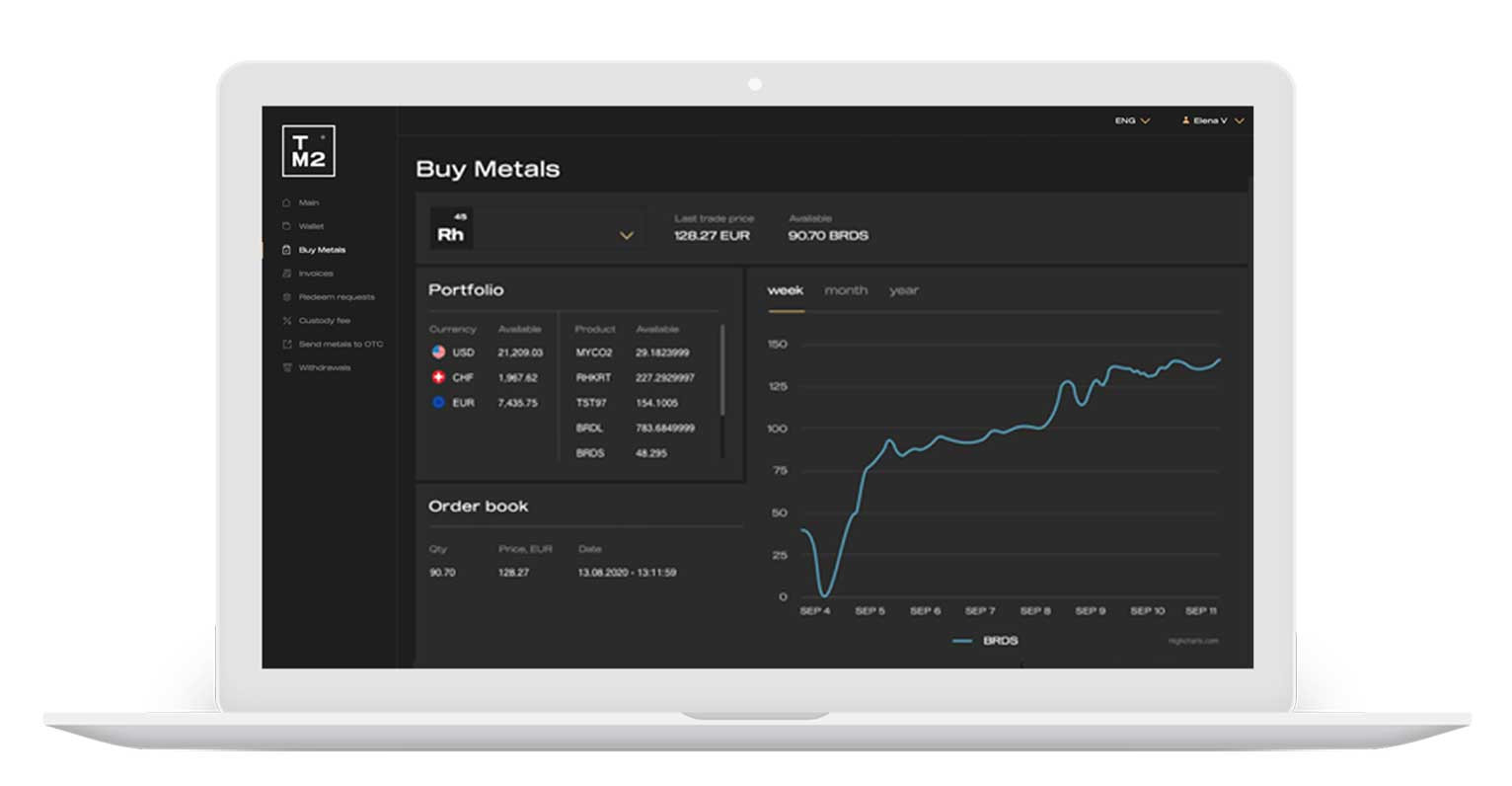

Technology Metals Market (TM2) is the world's first issuing and trading platform for technology metals connecting institutional investors, physical markets and proprietary traders with metals issuers — miners, refiners, recyclers and mints.

ТМ2 is the globe’s first company providing direct investment opportunities in the high-value metals that power technology worldwide.

We had a conversation with Petur Georgesson, Founder/CEO, to understand the company in depth.

Q. How do you measure success? How are these metrics determined?

As for quantifiable measurements of market success, the main ones are growth of members and volumes as it would be for any exchange. Going beyond the quantifiable, the development of our culture and our brand are something we are quite proud of and consider our greatest measurement of success. In fact, the overwhelmingly positive feedback we have received from the start has proven to us again and again that TM2 started and continues on the right path.

Q. Tell me about a time you took an unexpected initiative.

Earlier this year, TM2 took the initiative of making the entire team a shareholder.

Culture has an interesting way of defining itself. We didn’t expect to be 65 people already, certainly didn’t expect them to be across 7 offices with the most recent addition being in Shanghai. But we realized that hungry people all have one thing in common. We love to hunt and by making everyone a partner, everyone is now eating at the same table together. It’s an empowering feeling.

Q. How was the TM2 platform originated and how does it distinguish itself from your competitors?

The early, core, TM2 team observed the inevitable impact of technology on the resource markets. Growing EV, mobile devices, solar and renewable energies, semiconductors, aerospace technologies and related industries were driving a surging demand for technology metals in an unsustainable manner. The writing was on the wall.

At the same time, it was obvious that mining and metal production in general could not keep up with demand, which makes these technology metals attractive investments as they enter a new supercycle.

Most metals except gold, silver, platinum and a few others did not have any transparent investment market. TM2 came forth to democratize technology metals and make this market accessible and transparent. It was so obvious that we just couldn't miss the opportunity of creating a market based on direct exposure to these metals.

TM2 provides instant settlement, direct title to 100% physically-backed metals, and strategic investments with the added protection of transparent interactions among investors, metal issuers, and custodians all over the world. We offer a range of collective services that are not offered in any other exchange venue globally.

Q. How does electronic trading happen on the TM2 platform?

Our primary market is bid only and acts as the main gateway to the physical metal in TM2. Issuers will list their metals and sell them to anyone at a retail or institutional level; settlement is instantaneous. From private investors to funds, from institutions to end-users, everyone is included. Once the metal is sold it is already stored at a third-party custodian, of which we have agreements with 100+ locations globally, where it can be physically redeemed or traded effortlessly in our secondary market.

We offer the ability of a long position hold, day trading with fast tactical maneuvers and the ability to redeem any products you wish to hold in your hands or use in production.

This is all possible because of our global network of partners, from Loomis to Malca-Amit and others.

Q. How are all trades settled directly with TM2?

TM2 acts as a matched riskless principal to all executed transactions. That is to say, TM2 is simultaneously both the buyer and seller of metal transactions and so all transactions happen instantaneously. Primary issue technology metals are delivered and unconditionally allocated to a TM2 custody account and internally allocated by TM2 to a buyer’s custody account provided payment has been made.

In the case of secondary market operations, title passes concurrently upon the confirmation of execution of a transaction. This is because a seller of technology metals must have the metals before selling and a buyer must have funds in their account before buying. In the unlikely instance of a break, settlement will be postponed until all conditions are met.

Q. Talk about your recent association with Nasdaq. How has the partnership been a successful one?

Nasdaq has been supportive of TM2 from the very beginning. Historically, they have been very involved in the digitalization and the democratization of financial markets, and TM2 fits right in. We are now running three layers of cooperation with Nasdaq, our "big brothers" as we often refer to them.

Q. What is TM2’s strategic and tactical growth plan?

We intend on becoming the landmark market for technology metals globally, with full coverage of the periodic table and full transparency. We want more people to learn about this new and unique opportunity to invest in metals. It's a new level of freedom and democracy both for investors and producers to get access to a direct trading market without any intermediaries and with the full transparency and accessible information regarding the sustainability requirements demanded by the public. Next year we will launch our derivatives market and generally look forward to an exciting 12 months of new and expanded product offers.

Q. Tell us a bit about your metals pipeline.

Q. Tell us a bit about your metals pipeline.

Deep research and interaction with 1500+ companies across 35+ metal verticals results in an unprecedented origination and data extraction process. We are bringing multiple tradable products: graphite, vanadium, cobalt, rhodium, rhenium, iridium, and many more. We are already listing and trading a variety of metals like ruthenium, indium, osmium, tellurium and dysprosium, just to name a few. We expect 30+ additional metal listings by the end of this year.

Q. How does one become a member?

It is a simple and easy journey to become an active member of the TM2 platform. The first step you take is to visit our webpage www.tm2.com and register. After providing necessary information, a confirmation email and a welcome letter is sent out for new members to verify their registration. After the account has been set up and information has been verified, members can start trading and learning more about technology metals.

To ensure market integrity and fairness, TM2 maintains robust systems that control, detect, and report incidences of market manipulation, abuse, and other inappropriate trading behavior.

Meet the Founder & CEO

Petur Georgesson founded TM2 in 2018 alongside his partners Sergey Karulin and Zakhar Nedashkovskiy. The trio shared a common belief that global markets could be harnessed by the power of technology, transparency, empowerment, democratization and physical metal backing.

Insurance and capital markets